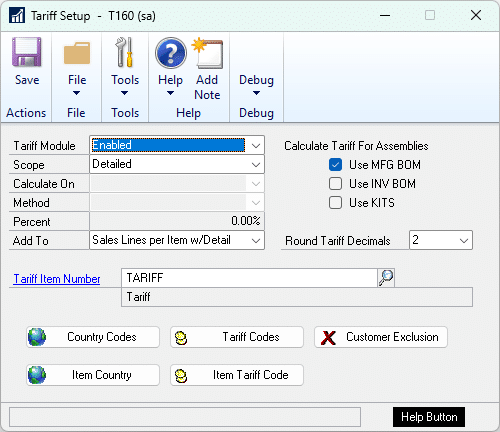

Tariff Setup

HelpID: 713622013

Navigation: Tools >> Setup >> Company >> Tariff Setup

TARIFF MODULE

- Enabled: Activates the module. You must close GP and log-in again for the setting to take effect.

- Disabled: Disables the module. You must close GP and log-in again for the setting to take effect. You can perform all of the necessary setup while the module is disabled and then turn it on when ready to go-live.

SCOPE

- Global: uses the settings from the Tariff Setup window only to calculate a tariff surcharge on every sales document.

- Detailed: uses Tariff Codes and Item Tariff Codes Assignment to calculate detailed tariff on a per sales line basis.

- Custom: uses a stored procedure to calculate tariff for the entire document. This can be added to the document as a single sales line or added to the Miscellaneous field. See CUSTOM SCOPE at the end of this document.

CALCULATE ON (Global Scope only)

- Subtotal: Tariff will be calculated based on the document subtotal.

- Sales Inventory Items: Tariff is calculated on a per sales line basis. This option uses the Method and Percent to calculate a default tariff on each sales line. An optional stored procedure (wspSalesLineTariff) can be edited to provide custom logic at your site to perform a tariff calculation that will override the default. See the end of this document for more information on editing the wspSalesLineTariff stored procedure.

METHOD (Global Scope only)

- % Value: value is the Current Cost or Standard Cost from Item Maintenance

- % Extended Price: tariff is based on the sales line extended price

PERCENT (Global Scope only)

- Enter the percentage used to calculate the default sales line tariff

Add To

- Misc. Charge Field: adds the total amount of tariff for the document into the Misc. Charge field on Sales Transaction Entry.

- Sales Lines as Total: adds a line to the sales document for the Tariff Item Number. It sets the Extended Price of this item to the total amount of tariff.

- Sales Lines per Item: adds a tariff line per line item on the document using the Tariff Item Number. The Item Description will be modified to “Tariff For:” plus the Sales Line Item Number receiving the tariff calculation.

- Sales Lines per Item w/Detail: populates an additional level below the sales line tariff with the Tariff Code and Amount. The detail is added to the SOP Line Comments and will print as many tariff codes as needed below the Sales Line. This is particularly useful with Make Items where the assembly may contain numerous components with different tariffs. See Tariff Calculation for more explanation.

Calculate Tariff For Assemblies

For items will a Manufacturing Bill of Materials, Inventory Bill of Materials, or Inventory Kit, the tariff calculation can look through the assembly to find purchased parts and retrieve the tariff on those items. It explodes the BOM and extends the quantities, so selling 2 of the finished good results in multiplying all BOM quantities by 2. The tariff for the sales line is calculated by adding up the tariff on all components in the assembly.

Round Tariff Decimals

Choose how to round the tariff dollar amount. Do not set this to less than your functional currency decimals or you will lose value in the calculation.

Tariff Item Number

When applying tariff by using a sales line you need to provide a Tariff Item Number. This must be a Misc Charges, Services or Flat Fee item. For the Sales GL account on the item specify an “Applied Tariff Revenue” Account. All of the typical required setup must also be completed:

- Quantity Decimals – the tariff item will always be in a Quantity of 1 on sales transactions. Unless there is another reason for having decimal places on this item it should be set to ZERO.

- U of M Schedule should be something where the Base UofM is 1 EA or EACH, or something comparable. The tariff item will be added to transactions using the base U of M.

- Item-Site assignment – assign the item to the site(s) where it will be sold out of

- Price List – create a price list or extended pricing price sheet for the Tariff Item. The actual price will be calculated but GP requires this setup.

- GL Accounts – in particular the SALES ACCOUNT should be set to an APPLIED TARIFF REVENUE account.